Last year was a rough year for so many people, including me.

One of the biggest lessons learned was the importance of having a little money saved up for any unexpected expense.

Why should you save money for a rainy day?

So, you know how life can be a bit unpredictable, right?

That’s why having some money saved up for a rainy day is like having a financial safety net.

Picture this: unexpected car repairs, sudden medical expenses, or even a job hiccup – life’s curveballs can come out of nowhere.

Having a little stash set aside helps you handle these surprises without stressing about where the money’s gonna come from.

It’s not just about dealing with emergencies; having savings gives you peace of mind and the freedom to pursue opportunities without constantly worrying about the next unexpected expense.

So, think of it as your own personal superhero fund – ready to swoop in when life throws a curveball your way!

That’s why I created this Rainy day savings challenge, to help you get started and build your own Rainy Day Fund.

What does the Rainy Day Savings Challenge include:

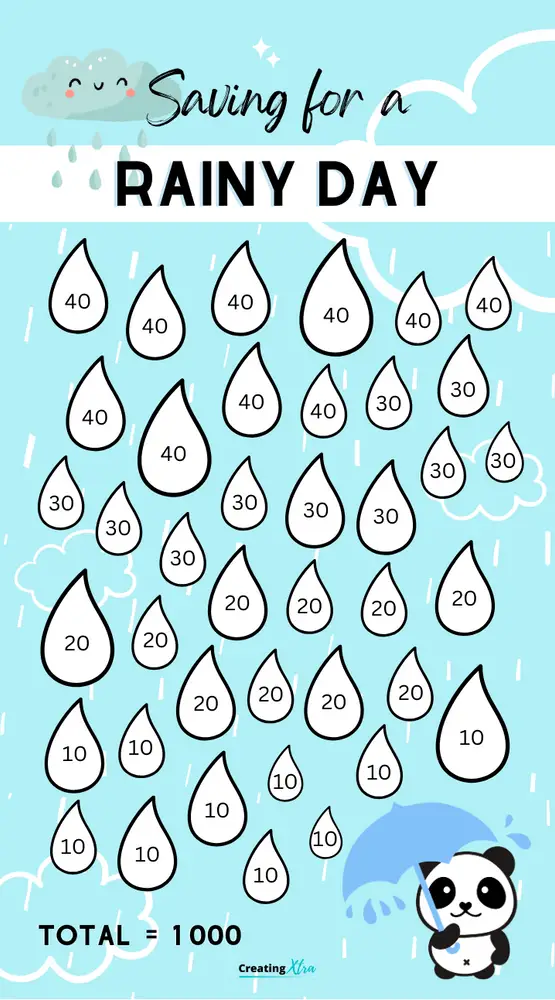

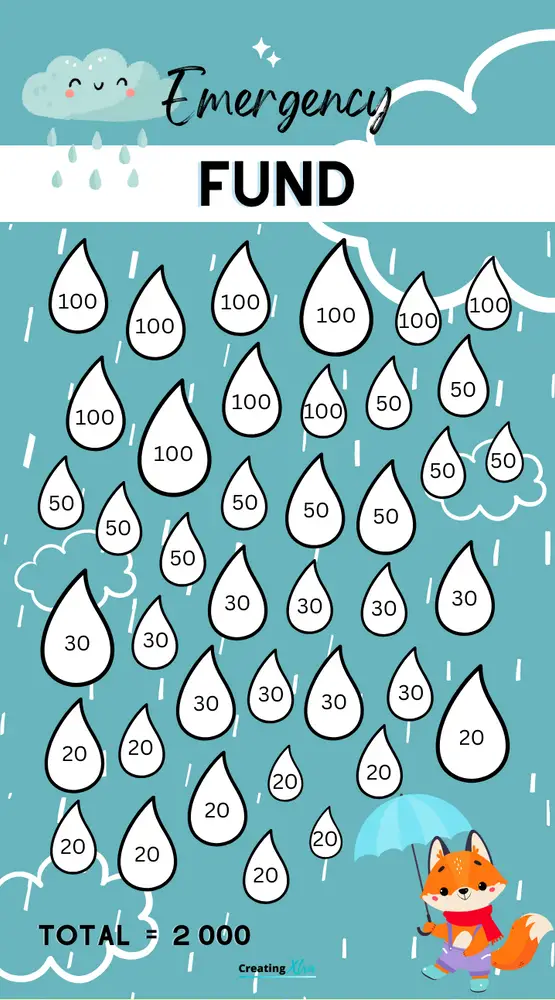

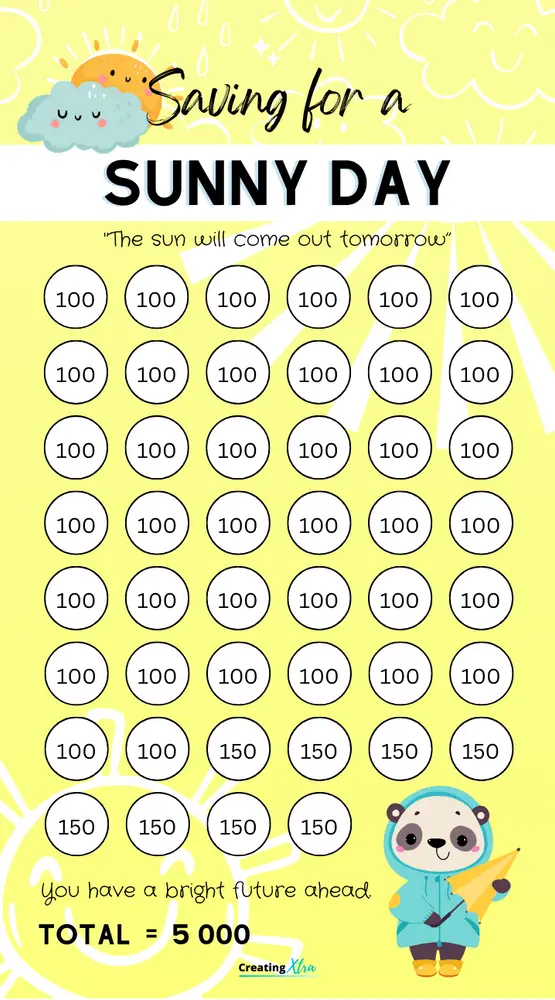

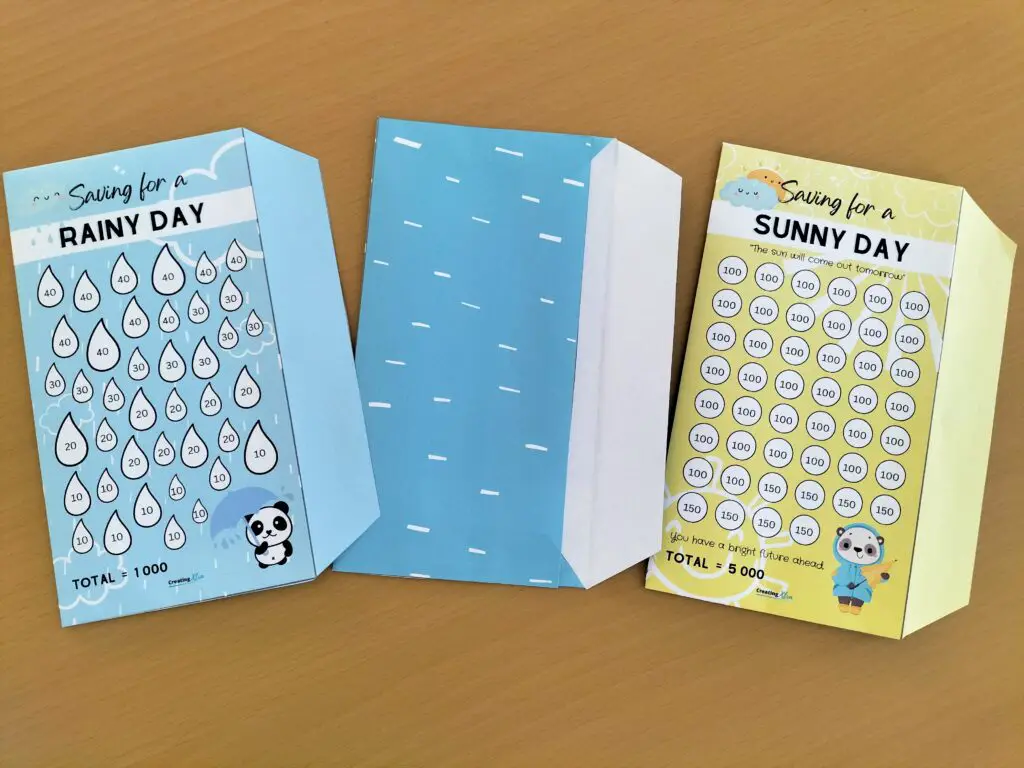

The Rainy Day Savings Challenge set consists of 3 x A6 trackers.

- Save for a Rainy Day – save 1000

- Emergency Fund – save 2000

- Save for a Sunny Day – save 5000

Why did I include save for a sunny day?

I included a “Save for a Sunny day” savings challenge, because it won’t rain forever. At the risk of sounding corny – the sun will come out tomorrow. I think it’s important to start saving for the good and the bad days. This way you will have a bright future ahead.

How to do the rainy day savings challenge?

- Get the Rainy Day Savings Challenge set on my South African store or here on Etsy.

- After purchase the pdf file will be available immediately for download.

- Print it out.

- Choose which savings challenge you want to do first.

- Start saving. Get a piggy bank, a jar or an envelope to keep your savings in. Every time you add money to your piggy bank you mark off how much you added on the savings challenge.

- When everything is marked off on a savings challenge you will have saved the amount shown on the bottom of the tracker.

a Rainy day – savings Envelopes

Now you can create an emergency savings fund with these super cute Savings Envelopes and have a whole lot of fun along the way.

- Get the Saving for a Rainy day – Savings Envelopes in my online store here (if you’re South African) or on Etsy.

Why should i use a savings tracker?

Using a savings tracker is like having a GPS for your money – it keeps you on the right path.

A savings tracker helps you set goals and stay accountable.

Watching your savings grow over time is seriously motivating. It’s like a little cheerleader encouraging you to keep up the good work.

So, whether you’re saving for a dream vacation or just building that rainy-day fund, a savings tracker is your trusty sidekick in the money game!

View my most popular savings trackers here:

If you liked this savings challenge, check out some of the other savings challenges on my blog. There are loads of Free and premium savings trackers.

- Free Money Savings Envelopes

- Tens, Twenties & Fifties Savings Challenge set – In A4 and A6 sizes with matching cash envelopes.

- Bee Savings Challenge – Save 500, 1000 and 2000

- Free 100 Envelope Challenge

- Free Money Savings Printables

- Free 12 Months Boho Savings trackers – A6 size